SELECTIVE INSURANCE GROUP (SIGI)·Q4 2025 Earnings Summary

Selective Insurance Crushes Q4 as Combined Ratio Hits 93.8%, Stock Jumps 3%

January 30, 2026 · by Fintool AI Agent

Selective Insurance Group (SIGI) delivered a standout Q4 2025, with operating EPS of $2.57 crushing the $2.18 consensus by 17.7% . The combined ratio improved dramatically to 93.8%, down 4.7 points year-over-year, as the company benefited from no net prior year reserve development and strong investment income . Full-year ROE reached 14.4%, with operating ROE of 14.2% exceeding both the 10-year average of 12.1% and 5-year average of 12.5% .

Did Selective Insurance Beat Earnings?

Yes—and decisively. Selective Insurance posted its strongest quarter of the year, beating on both the top and bottom line:

*Values retrieved from S&P Global

The Q4 combined ratio of 93.8% was the best quarterly result of 2025, bringing the full-year combined ratio to 97.2%—just outside the original 96%-97% guidance and at the low end of the revised 97%-98% guidance provided last quarter .

What Did Management Guide?

Selective Insurance provided detailed 2026 guidance that implies continued margin improvement:

Management expects underlying combined ratio improvement in both Personal Lines and Commercial Lines, with E&S continuing its strong performance . The 2026 guidance embeds an overall expected loss trend of approximately 7.5%, up from 7% assumed a year ago, with casualty trend assumptions near 10% excluding Workers' Compensation .

How Did the Stock React?

SIGI shares jumped +3.3% on the earnings release, closing at $84.08 on January 29, 2026. The stock is now trading above both its 50-day moving average ($81.52) and 200-day moving average ($82.57).

The positive reaction reflects:

- EPS beat magnitude (+17.7% vs consensus)

- Q4 combined ratio improvement (93.8% vs 98.5% year-ago)

- Constructive 2026 guidance with margin improvement trajectory

- Strong capital position ($3.6B GAAP equity, AM Best A+ rating)

What Changed From Last Quarter?

Commercial Auto Reserves Strengthened

Selective strengthened commercial auto reserves by approximately $190 million in 2025, with the majority attributable to 2024 and 2025 accident years . Management increased the expected severity trend for commercial auto liability to approximately 10% .

Workers' Comp Favorable Development

Q4 benefited from favorable workers' compensation development that offset unfavorable prior year emergence in commercial and personal auto lines . The annual tail study drove about half of the favorable emergence, with the balance from accident years 2022 and prior .

New Jersey Personal Auto Drag

All personal auto prior year development is attributable to New Jersey, which represents about 30% of the personal lines portfolio . Management cited pro-plaintiff legislative changes including pre-suit disclosure requirements, increased minimum limits, and a lowered bad faith standard as drivers of elevated loss trends in the state .

Segment Deep Dive

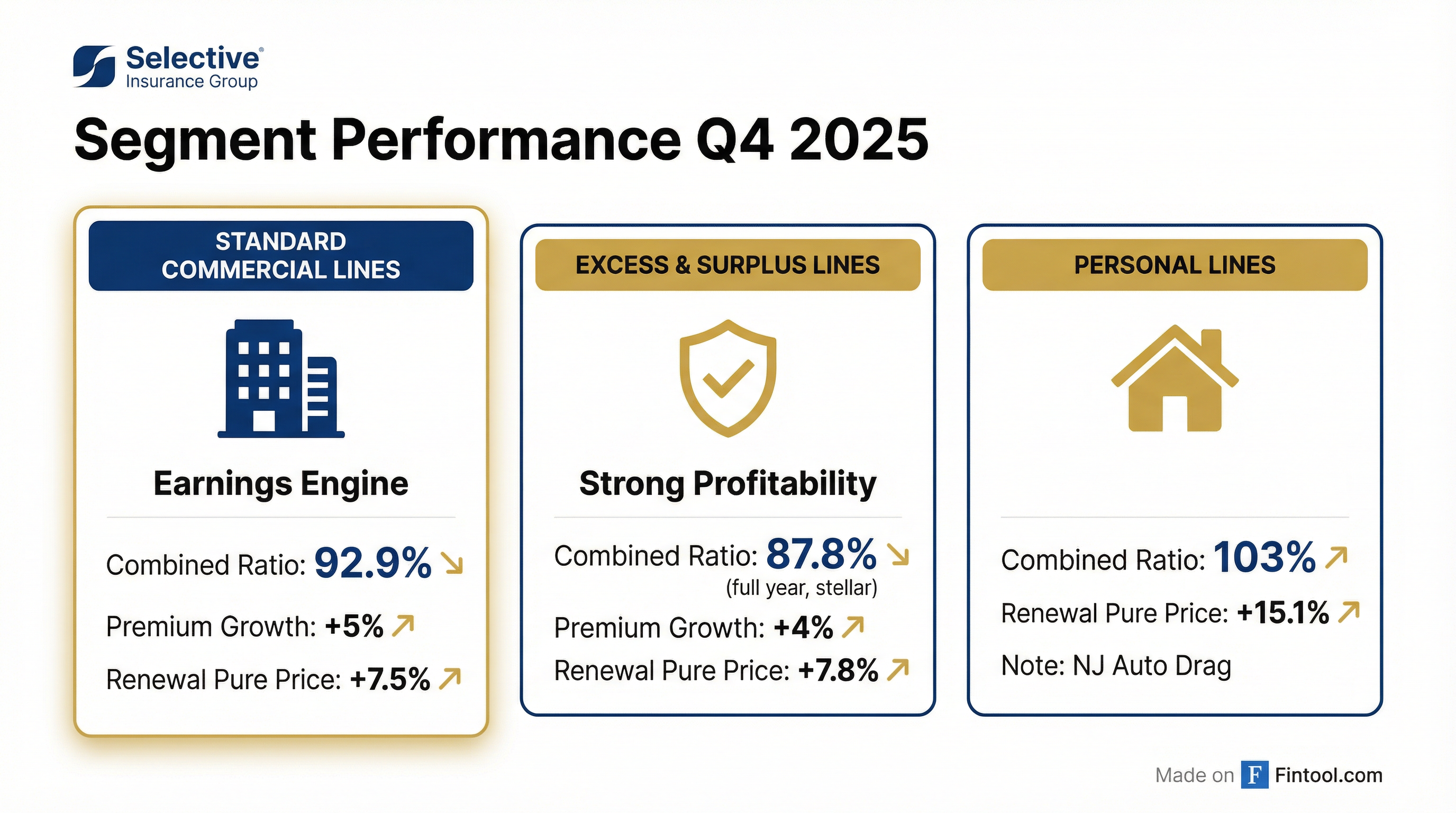

Standard Commercial Lines (Earnings Engine)

- Q4 Combined Ratio: 92.9%

- Premium Growth: +5% YoY

- Renewal Pure Price: +7.5% (8.5% ex-Workers' Comp)

- Retention: 82% (down 3 pts YoY)

General Liability pricing increased 9.8%, and Commercial Auto pricing increased 8.6%, with liability price increases continuing to exceed 10% .

Excess & Surplus Lines (Star Performer)

- FY 2025 Combined Ratio: 87.8%

- Q4 Premium Growth: +4%

- Renewal Pure Price: +7.8%

E&S remains the strongest segment with extremely strong operating margins. The Q4 reserve adjustment of $10M was de minimis and spread across the 2020-2023 accident years .

Personal Lines (Turnaround in Progress)

- Q4 Combined Ratio: 103% (vs. 91.7% year-ago)

- FY 2025 Combined Ratio: 100.6% (vs. 109.3% in 2024)

- Renewal Pure Price: +15.1%

Q4 deterioration was driven by higher catastrophe losses (+6.2 pts) and current year casualty loss costs (+8.1 pts) . Results outside New Jersey are significantly more favorable .

Key Management Quotes

On Underwriting Discipline:

"We are leveraging our tools, granular insights, and differentiated operating model to drive higher renewal retention on our best-performing business, and meaningfully lower retention on our poorer-performing business through appropriate rating actions." — John Marchioni, CEO

On Commercial Auto:

"We've seen movement from an incurred basis, similar to what we've seen on the paid side... We're pleased with the results of [outside] surveys on both the actuarial reserving and planning process, as well as the claims process." — John Marchioni, CEO

On New Jersey:

"Some of the New Jersey dynamics that we see in personal lines also apply to commercial lines. New Jersey has always been a higher litigation rate state... legislative changes have made it more fertile ground for litigation abuse and social inflation." — John Marchioni, CEO

Capital Allocation & Returns

Selective Insurance returned $182 million to shareholders in 2025 through dividends and share repurchases . Key capital highlights:

Management targets returning 20%-25% of earnings to shareholders through dividends, with opportunistic share repurchases .

Investment Portfolio

After-tax net investment income was $114 million in Q4, up 17% YoY, generating 13.6 points of ROE . The portfolio remains conservatively positioned:

- Average Credit Quality: A+

- Duration: 4.1 years

- 2026 NII Guidance: $465M (+10% YoY)

Management emphasized the portfolio's strong embedded book yield provides durable income even if interest rates decline .

Reinsurance Update

Selective successfully renewed its property catastrophe reinsurance program effective January 1, 2026 :

- Retention: $100M (unchanged)

- Coverage Exhaustion: $1.5B (up from $1.4B)

- Peak Peril (US Hurricane): 5% of GAAP equity for 1-in-250-year PML

The renewal was completed with meaningful risk-adjusted pricing decreases and improved terms and conditions .

Technology Investments

The 2026 expense ratio is expected to increase by about 0.5 points as Selective makes strategic technology investments . Management noted:

- Technology investment as a percentage of premium has continued to ramp up

- Strategic investment dollars have more than doubled over the last three years

- Split is now 50/50 between strategic investments and "keeping the lights on"

The focus is on operational efficiency, improved decision-making, and enhanced underwriting and claims outcomes through data, analytics, and AI .

Historical EPS Performance

*Values retrieved from S&P Global

The Q4 2025 beat breaks a string of misses, driven by favorable workers' compensation development and strong investment income.

Forward Catalysts

- Margin Improvement: Management's multiyear plan points to continued margin improvement in 2027

- Geographic Expansion: New states have contributed 1-2 points of growth annually and are expected to continue

- E&S Retail Access: Recently opened retail access channel for E&S distribution

- Technology Benefits: AI and analytics investments expected to drive operational efficiency and improved outcomes

Key Risks

- Commercial Auto Severity: 10% severity trend assumption remains elevated

- New Jersey Exposure: ~30% of personal lines and significant commercial exposure to a challenging litigation environment

- E&S Pricing Competition: Industry commentary suggests more aggressive pricing behavior in both property and casualty E&S

- Casualty Loss Trends: Overall loss trend assumption increased to 7.5% from 7%

Selective Insurance Group is celebrating its 100th anniversary in 2026.